Digital-only account holders are a valuable commodity for neobanks and incumbents alike—and neobanks are hoarding it for themselves. These independent, digital-only banks command a bigger slice by far of UK digital-only bank account holders than direct banks, which are mostly operated by incumbents. This is threatening legacy banks' digital growth ambitions. Establishing a strong digital user base is invaluable for staying relevant as consumers increasingly flock online to manage all aspects of their lives and finances.

UK incumbents can fight back against neobanks and expand their digital account holder numbers. Neobanks' novelty has started waning as they've aged into the mainstream, and a mix of pandemic difficulties and business model flaws have made profitability elusive for many. Such circumstances have spotlighted neobanks' precariousness to consumers—but incumbents still carry baggage of their own.

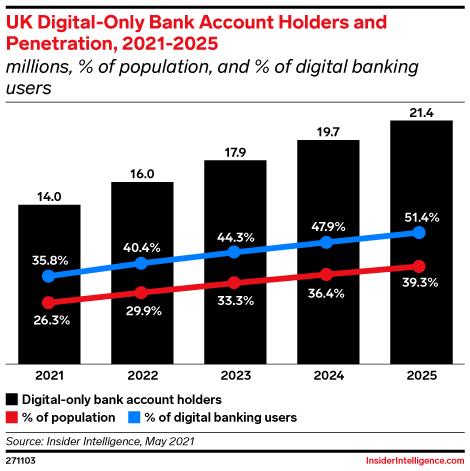

We forecast UK digital-only banks' account holder numbers will surge 52.8% in the next five years, hitting 21.4 million. For context, giants NatWest and Barclays combined had around 20.9 million digitally active users in Q3 2021, per S&P Global data. Neobanks will maintain their grip on younger consumers, giving incumbents an uphill battle...

| Report Preview  * This chart and data were pulled from The UK Digital-Only Banks Report by Insider Intelligence. Purchase the report below for $995 for immediate access. * This chart and data were pulled from The UK Digital-Only Banks Report by Insider Intelligence. Purchase the report below for $995 for immediate access. | | | Digital-only account holders are a valuable commodity for neobanks and incumbents alike—and neobanks are hoarding it for themselves. These independent, digital-only banks command a bigger slice by far of UK digital-only bank account holders than direct banks, which are mostly operated by incumbents. This is threatening legacy banks' digital growth ambitions. Establishing a strong digital user base is invaluable for staying relevant as consumers increasingly flock online to manage all aspects of their lives and finances.

UK incumbents can fight back against neobanks and expand their digital account holder numbers. Neobanks' novelty has started waning as they've aged into the mainstream, and a mix of pandemic difficulties and business model flaws have made profitability elusive for many. Such circumstances have spotlighted neobanks' precariousness to consumers—but incumbents still carry baggage of their own.

We forecast UK digital-only banks' account holder numbers will surge 52.8% in the next five years, hitting 21.4 million. For context, giants NatWest and Barclays combined had around 20.9 million digitally active users in Q3 2021, per S&P Global data. Neobanks will maintain their grip on younger consumers, giving incumbents an uphill battle... | | | Other Related Reports |  Neobanks' breakneck customer growth poses an unavoidable threat for incumbents: The four largest US neobanks by user... ACCESS FULL REPORT |  Digital transformation is disrupting the banking industry. Incumbent financial institutions (FIs), Big Tech firms, neobanks, and fintech companies will... ACCESS FULL REPORT | | |  To learn more about Insider Intelligence and our Financial Services coverage, click below and fill out the form, and a member of our team will be in touch with you. | | | | |

| |

| |

0 comments:

Post a Comment